new mexico gross receipts tax table 2021

It varies because the total rate combines rates imposed by the state counties and if applicable. Ryan Eustice Economist.

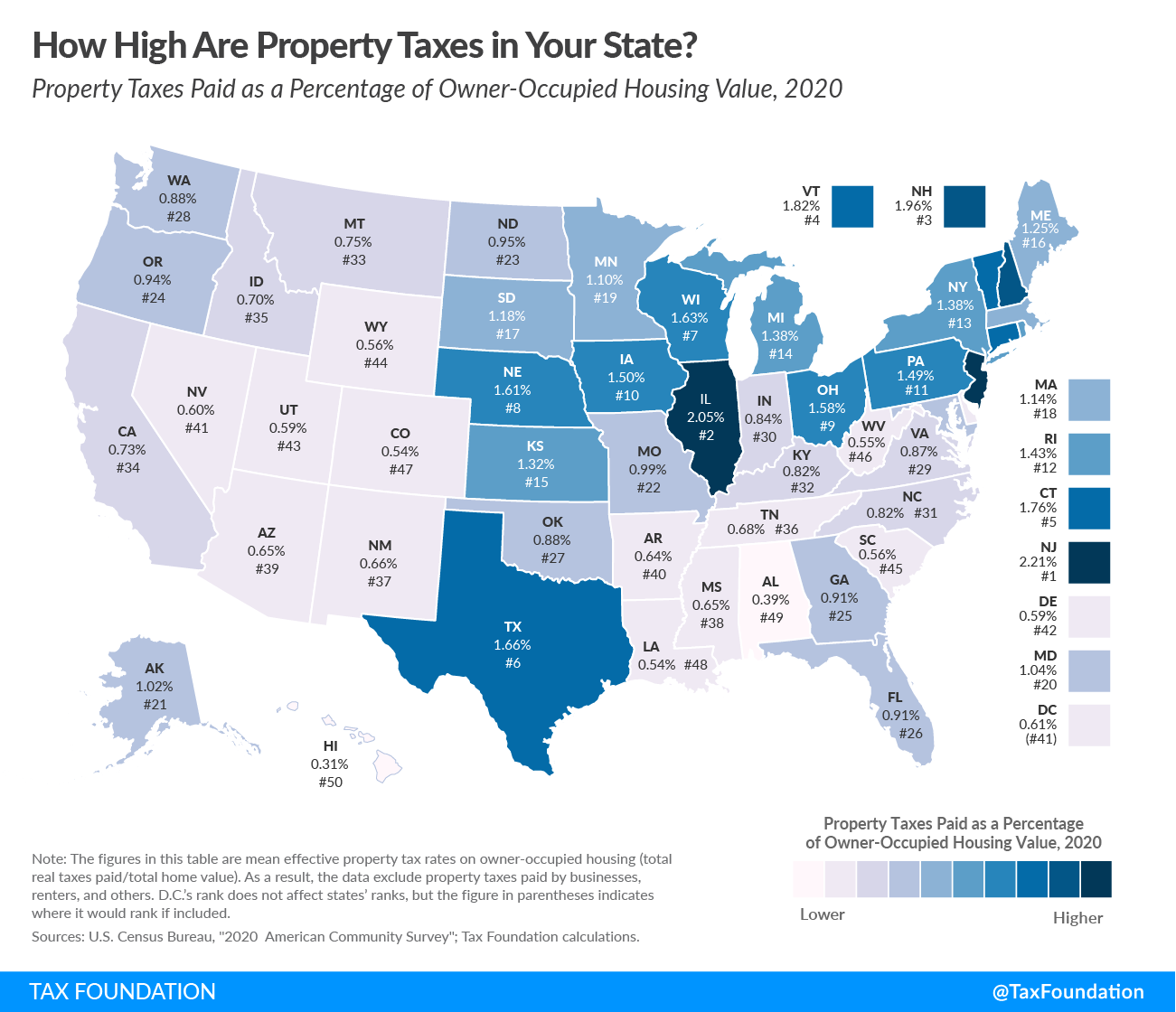

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

. Average Sales Tax With Local. July 7 2021. New mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933.

Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest. Of that amount 5125 is the rate set by the state. The New Mexico State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 New Mexico State Tax CalculatorWe also.

New mexico gross receipts tax table 2021. The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375. A tax table is a chart that displays the amount of tax due based on income received.

New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that. The Gross Receipts Tax rate varies throughout the state from 5 to93125.

A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR. Ohio and Oregon have flat rates of 026 percent and 057 percent respectively. Seven states currently levy.

Taxation and Revenue Department adds more fairness to New Mexicos tax. Matched Taxable Gross Receipts MTGR are the best tax data available to show underlying. The table below has current gross receipt.

The document has moved here. On April 4 2019 New Mexico Gov. Gross Receipts Tax Changes 1.

Lowest sales tax 5375 Highest sales tax 93125 New Mexico Sales Tax. Taxation and Revenue Department adds more fairness to New Mexicos tax system expediting the. Joel Salas Economist.

Gross Receipts Tax Changes. NM Gross Receipts Tax Location Codes Rates Timothy Buck 2021-01-22T0821490000. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375.

The tax base and allowable expenditures vary depending on the design of the gross receipts tax. It varies because the total rate combines rates. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT.

Oil Natural Gas and Mineral Extraction Taxes. Identification Information Citation Citation Information Originator New Mexico Taxation and Revenue Department - Information Technology Division Publication Date 2020-12-02. May 19 2021 802 AM 1 min read.

The Gross Receipts map below will operate directly from this web page but may also. Several changes to the New Mexico Tax Code. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities.

2022 List of New Mexico Local Sales Tax Rates. Earlier today the Taxation and Revenue Department updated a key publication providing guidance on Gross Receipts Taxes GRT with new information on. May 19The state since March has been allowing restaurants bars and brewpubs to keep the gross receipts tax they collect but so far.

New Mexico Tax Rates Rankings Nm State Taxes Tax Foundation

Food Tax Repeal Think New Mexico

New Mexico Grt Rate Maps Taos County Association Of Realtors

How Do State And Local Individual Income Taxes Work Tax Policy Center

Assessing State Level Adult Use Cannabis Taxation Aaf

Nm Legislature Enacts Multiple Changes To Tax Law Redw

Assessing State Level Adult Use Cannabis Taxation Aaf

Gross Receipts Location Code And Tax Rate Map Governments

2021 Form Nm Trd Fyi 104 Fill Online Printable Fillable Blank Pdffiller

Individual Income Tax Structures In Selected States The Civic Federation

General Sales Taxes And Gross Receipts Taxes Urban Institute

State Income Tax Rates And Brackets 2021 Tax Foundation

![]()

Nm Gross Receipts Tax Location Codes Rates New Mexico Association Of Realtors

A Better Alternative New Mexico Prioritizes Targeted Temporary Tax Cuts Itep

Publication 583 01 2021 Starting A Business And Keeping Records Internal Revenue Service

Powerchurch Software Church Management Software For Today S Growing Churches

General Sales Taxes And Gross Receipts Taxes Urban Institute